Counterpart Ventures Fund III: $132M

-

Counterpart Ventures’ early roots lie in corporate venture capital (CVC).

In our prior CVC leadership roles at Qualcomm Ventures and Recruit Strategic Partners, we hosted hundreds of candid “therapy sessions” with fellow CVC investors. We offered guidance on how to invest in nimble startups while navigating the often unpredictable dynamics of the corporate mothership. Along the way, we unintentionally became de facto therapists for the CVC community.

Yet when we launched Counterpart in 2018, we distanced ourselves from our CVC roots. Frankly, we were fatigued by the stigma attached to CVC. In hindsight, that was a major strategic misstep. Our fund lacked meaningful differentiation in a crowded market of lookalike venture firms.

So, we made a counterintuitive bet. We embraced our origins and hosted the first Counter community event in November 2018—bringing together 30 corporate investors to share raw, unfiltered narratives. What seemed like a non-obvious idea then is self-evident now.

Fast forward seven years.

That early bet evolved into Counter Club: the world’s largest and most engaged CVC community. Today, it includes over 650 corporate venture units represented by more than 1,500 investors. CVCs are the eyes and ears of corporate innovation, and Counterpart Ventures is uniquely positioned to unlock their full value—for the benefit of our founders.

To be clear: we are not a CVC, nor a“CVC-as-a-service” platform. We are a pure-play institutional venture fund—with an edge. Our unique access to the CVC ecosystem enables us to deliver proprietary customer access and upstream capital to our portfolio companies.

The next chapter at Counterpart is about fully unlocking this advantage—for our founders.

Today, we are proud to announce our $132M Fund III.

We have now crossed $250M in assets under management and have quietly become the best in the world at bridging traditional VC and corporate VC. With our fresh capital, we are looking for Seed & Series A enterprise software companies that bring disruptive AI-native solutions to antiquated industries.

We're tremendously thankful to our wonderful LPs for their continued support and alignment in our mission. This would not be possible without their unwavering conviction to such a contrarian strategy.

Building off the Success of Fund I & II

Looking back at our inaugural Fund I in 2018, we have already returned the capital and more.

We matured into Fund II with multiple exits, including Annex Cloud (Acquired: Open Gate Capital), Glidian (Acquired: Infinx), Intricately (Acquired: HG Insights), Rippey AI (Acquired: PayCargo) and Sense 360 (Acquired: Medallia, NYSE: MDLA).

Fund II Investment Highlights:

AI inventory management, retail analytics, merchandising and pricing.

Founder: Gurhan Kok

Round: Series B

Generative conversational-AI for group-based behavioral and mental health.

Founders: Surabhi Bhandari and Anurag Verma

Round: Seed

AI comms-loop on customer & prospect feedback for B2B businesses.

Founders: Eli Portnoy and Wendell Hicken

Round: Pre-Seed

Cloud-based data modeling solution for the enterprise.

Founders: Ajay Singh & Edward Khachian

Round: Series B

Fund III is live, active, and already investing.

Fund III Investment Highlights:

Modernizing the benefits ecosystem by giving employers smarter tools to manage and optimize healthcare spending

Founders: George Spurling and Chaim Kirby

Round: Seed

.png)

Gen-AI design manufacturing software for simulation and topology optimization in traditional manufacturing.

Founder: Michael Bogomolny Ph.D.

Round: Seed

infinitform.com

A next gen data orchestration platform for banks and financial services that transforms data through the power of AI.

Founder: Ann Olinger

Round: Pre-Seed

We are spending time in vertical and horizontal applications of AI poised to disrupt legacy functions within the enterprise.

The Why Now is Obvious.

The enterprise is at a turning point. When the CEO of one of the world's largest businesses says...

"We will need fewer people doing some of the jobs that are being done today, and more people doing other types of jobs. It’s hard to know exactly where this nets out over time, but in the next few years, we expect that this will reduce our total corporate workforce as we get efficiency gains from using AI extensively across the company." - Andy Jassy, CEO, Amazon. June 17, 2025

...we must pay attention. The AI transformation is well underway, and we have already placed several bets in transformational companies across healthcare, manufacturing, retail and more. Our proprietary sourcing network and corporate connections give us unrivaled access to the future of the enterprise.

Counter IV: AI Panel ft. Andrew Ferguson (Databricks Ventures), Sagi Paz (AMD Ventures), Rashmi Gopinath (fmr B Capital) moderated by Tanvi Narain (Counterpart Ventures).

How Are We Different? Counter Club

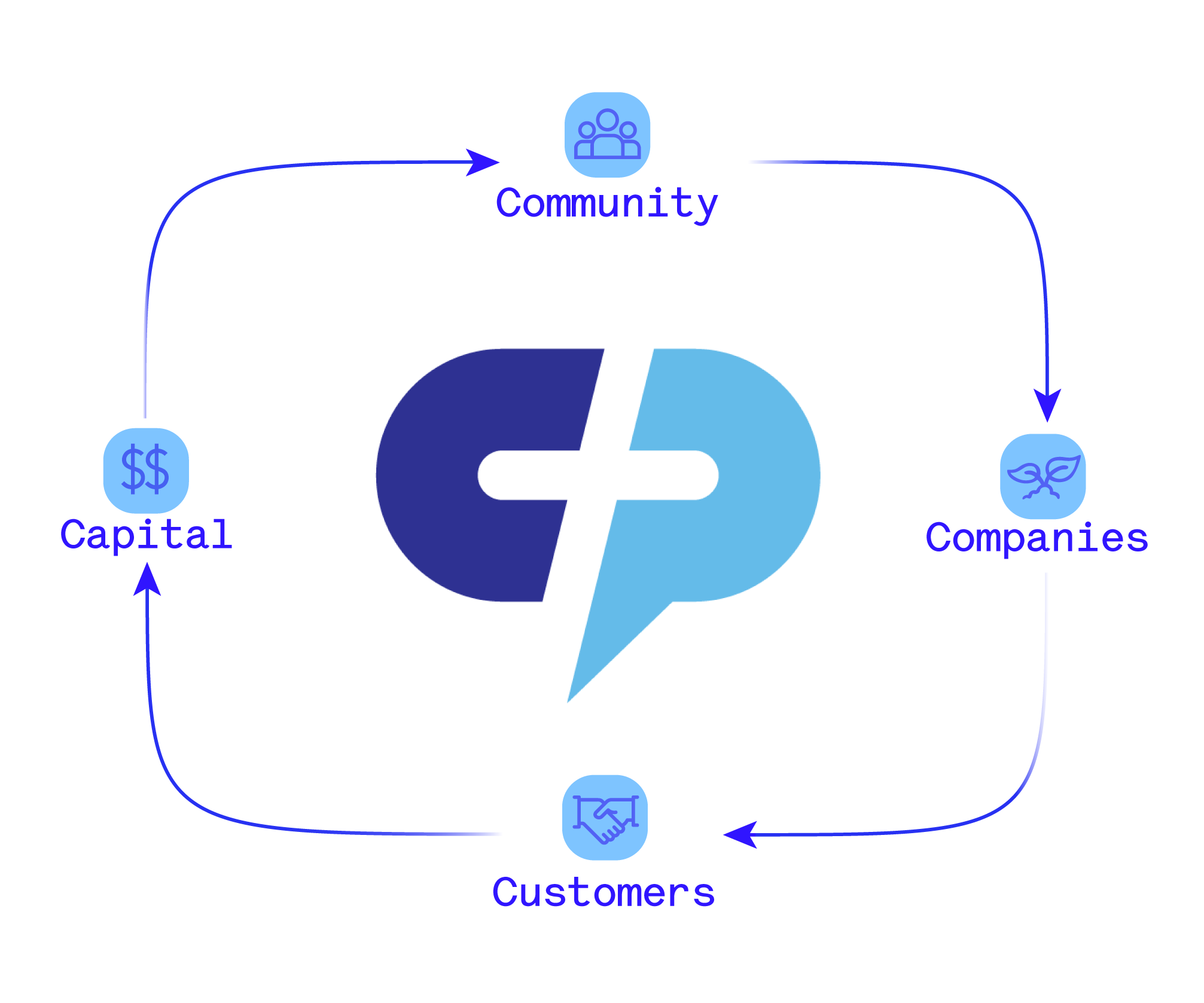

Founders care about three things: Customers, Capital and Talent. We’ve doubled down on the first two.

Our Counter Community provides four unique access points as institutional investors:

- Deal Flow: Proprietary network of 650+ active CVCs feeds our top of funnel pipeline.

- Diligence: Direct access to broad footprint of domain experts. Big companies might not be able to solve the problem, but they know the problem better than anyone.

- Customer Introductions & Strategic Partnerships: Monolithic entry point for enterprise and mid-market customer logo. This is a clever hack to scale a BD platform.

- Raising Follow-on Capital: Pole position for potential upstream capital and corp dev connections to land the plane (liquidity).

What matters most to founders post-investment is the access to #3 and #4. We not only connect to the right stakeholders within corporates but we can also secure the quick "no"—saving valuable time for founders. This eliminates the biggest frustration with corporates: the dreaded "slow maybe" and ambiguous signals.

This brings together the Counter Club Flywheel:

What’s in it for our CVCs?

We believe by creating upfront value with thought leadership through 1:1 conversations, content, and conferences to our private invite-only network we build trust.

Conference: Counter VI and CVC Week

Our flagship conference, which has morphed into our very first CVC Week from 8-12 September 2025 in San Francisco. A dedicated week for 1,000+ CVC investors from around the world. Counter IV, the conference main day, will be at the Saint Joseph's Art Society on September 10th.

Corporate VCs can join the Counter Club to register for one of the many events taking place.

Content: The CVC Playbook

We recently launched the first three chapters of The CVC Playbook, our authentic blueprint for corporations on how to launch or adapt a CVC fund. We’ve always believed that the best way to build something lasting is to build it together. For the past six years, hundreds of corporate investors have participated in conversations at our events to share what they’ve learned. They’ve talked about what worked, what didn’t, and what they’d do differently. We have captured all of this information and distilled in into The CVC Playbook.

Each chapter is packed with tactical insight pulled directly from CounterClub contributors who’ve done the work. Our first three modules live today include:

- How to Launch a CVC Fund

- How to Build Your Reputation and Position Your Fund (Internally & Externally)

- How to do Early Stage Investing Right

The CVC Playbook is live on counterclub.vc, available exclusively to qualified corporate investors at no cost.

Community: counterclub.vc

The online platform hosts a plethora of online and offline content and events for our investors along with 1:1 matchmaking opportunities.

Final Words

To Corporate Investors: Join the Counter Club, The Community Driven Network of CVCs

Everything we offer—educational content, global events, curated matchmaking, and trusted deal flow—is 100% free and made possible by our partners and members giving back their learned experience. If you’re not already in the room, it’s time to ask why.

To Founders: We Welcome Your Pitch

If you’re founder building in the new era of AI to dis-intermediate legacy solutions within the enterprise, we want to hear from you. Please reach out to a member of the team—warm intros are always preferred.

—

The Counterpart Ventures Team

.png)

.svg)

.svg)

.svg)

.svg)